Can the sector depend on the combination of low feedstock costs and increased exports of refined products to extend a 10-year period of record profits?

Mature industry

- 1% annually growth in domestic demand for refined products over past three decades.

- Potential for 4-5% reduction in demand due to increased mileage standards for cars and trucks

Will historically low feedstock costs help grow profits?

- Already excel at processing lower cost heavy crude oil

- Uncertainty about continuing price differential for US crude

- Have implemented effective tools for optimizing crude oil slate

- Already achieved operating efficiencies in refinery operations

Will restrictions on US crude exports continue to create:

- Export markets for products refined from US produced light, sweet crude?

- Competitive barrier, which restricts export of US produced light, sweet crude oil even though it is a better economic fit for refineries outside the United States?

- Ability to limited investments required to process US produced light, sweet crude crudes?

Will changes in the US regulatory environment have a direct impact on profitability?

- Deregulation of US crude exports will change competitive environment

- Greater price volatility for feedstocks

- Elimination of export markets for refined products

- Requirements for increased vehicle mileage standards will decrease US based demand

EnCORE sees Transformation Opportunity

Improve ability to place the largest volume of product into the highest price markets -EVERYDAY

Multiple challenges hamper the optimized distribution of refined products

- Heavy reliance on spreadsheet models

- Inefficient communication among stakeholders

- Continual pressure on downstream margins

- Increasing transaction volumes

- Complex distribution management processes

- Dependence on disparate systems inherited through M&A transactions

Opportunity for visionary refiners to transform refined product supply chain:

- Apply proven mathematic techniques to drive sophisticated models of distribution network

- Evaluate impact of operating and financial decisions on the profitability of refined product distribution

- Embed plan into daily operations and monitor performance against plan

- Make real-time adjustments as events develop

Two case studies to demonstrate transformation opportunity

Case Study: Maximize Value of Every Molecule in Petrochemical Supply Chain

A petrochemical firm is in the business of making a certain finished product. In making the finished product, their three facilities generate a large number of by-products. Typically, these by-products have a high disposal cost and create a distraction to the focus on the finished product. So, the client sold these by-products at cost to quickly get them out of the way. But, one product is used as a feedstock for other products, which makes the by-product a marketable commodity.

| Company executives were stunned to learn from the model that at times it made sense to make less finished product to maximize the value of other by-products. |

Along comes a new management team that recognized that under certain conditions sale of some of the by-products could be quite lucrative. They asked a key question: “Can we make more money by treating these by-products as products themselves?”

Through the power of simulation modeling we were able to imagine, in a data-driven way, a future world that did not currently exist—one where the company managed operations in such a way that it maximized the full value of its production inventories by allowing each product and by-product to earn its way in the value stream. Company executives were stunned to learn from the model runs that at times it made sense to make less finished product to maximize the inventories of the more valuable by-products.

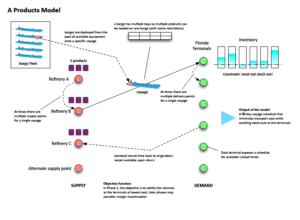

Case Study: Optimize Value of Critical Feedstock

Now let us take a look at the tailgate of the refinery, the place where a range of “refined” products emerge, along with a number of intermediates (by-products many of which are consumed by other operating units within the company). One of our refinery clients recognized that it could increase its operating profit by improving its ability to deliver the right product to the right market at the right time. However, its existing spreadsheet based models could not answer the critical question: “What is the optimum deliver schedule this batch of products?”

| Schedule optimization is complex.

The optimum solution is based on a set of trade-off among: § Availability of transportation vessels § Changing market prices § Market area inventories § A host of other constraints and criteria |

We developed an optimization model that used a financial value objective to calculate each and every possible match of product to market, choosing the best solution for the company, week after week. Our model evaluated the tens of thousands of feasible possibilities and selected the optimal solution that provided the greatest value.

The company found that in many cases the more expedient choices for shipping were not necessarily the most valuable.